Market Update

- Ricardo Rodriguez

- Oct 29, 2017

- 2 min read

“You work hard for your money. We’ll work hard to protect it.”

Market Direction Is Important –

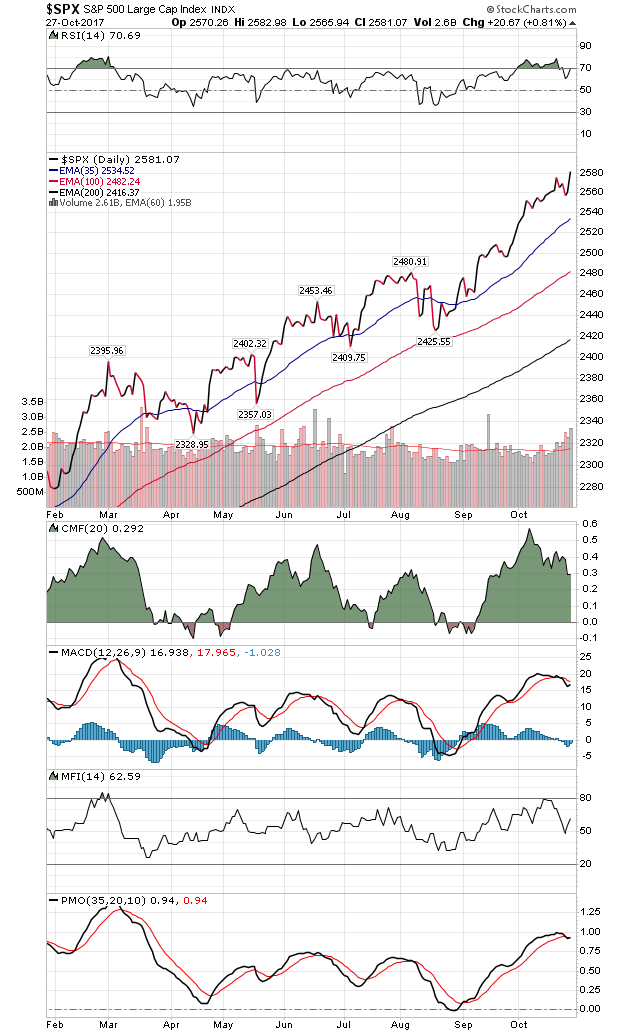

Updated Chart of the S&P 500 and Secondary Signals

Of our Four secondary indicators under our MTI:

Relative Strength Index (RSI)-Positive

Chaikin Money Flow (CMF)-Positive

MACD- Negative

Money Flow Index-MFI-Positive

More on the Market and the Economy:

Stocks finished higher on Friday on solid economic data, with S&P 500 rising .2% for the week, marking its seventh consecutive weekly gain.

This week data will be released on consumer spending, manufacturing, the trade deficit, the jobs report and the Fed’s FOMC meeting announcement.

Despite the hurricanes, the economy expanded at a solid 3% in the third quarter, driven by a 2.4% rise in consumer spending and a 3.9% rise in business investment.

New home sales jumped to a ten-year high in September, rising 18.9% to an annual pace of 667,000. At the current sales pace, it would take five months to exhaust the available supply.

Americans signed fewer contracts to buy homes in September, as tight supply continues to hamper the market. According to the National Association of Realtors, “demand exceeds supply in most markets, which is keeping price growth high and essentially eliminating any savings buyers would realize from the decline in mortgage rates from earlier this year…“Buyers looking for a little relief from the stiff competition from over the summer may unfortunately be out of luck in the coming months. Inventory starts to decline heading into the winter, and many would-be buyers from earlier in the year are still on the hunt to find a home”.

The Atlanta Fed’s GDPNow final forecast for third quarter growth is 2.5%, edging down from 2.7% following the release of advance economic indicators.

Halloween has gained in popularity among US consumers, and this year an estimated 179 million Americans will celebrate the holiday, according to the National Retail Federation, with expected spending around $9.1 billion.

Source: National Retail Federation

Comments